DBS transforms its data center with AMD EPYC™ CPUs

AMD EPYC CPU-powered Dell EMC PowerEdge servers help reduce costs and power consumption.

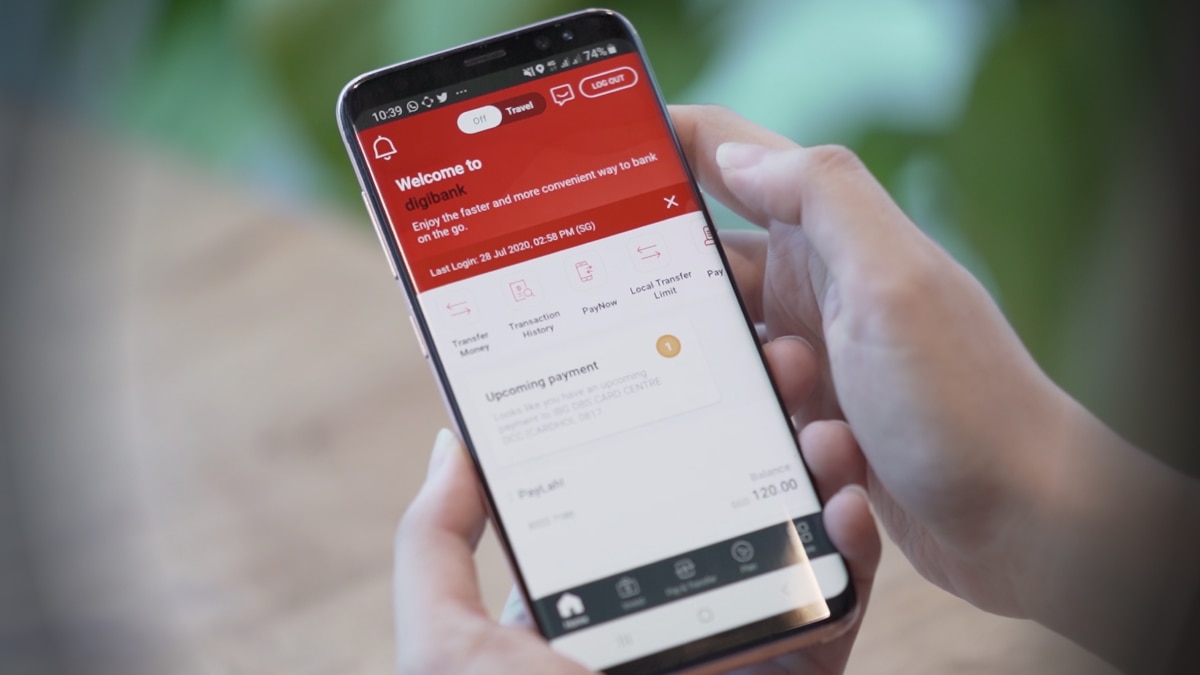

DBS Bank Ltd. has been one of Asia’s leaders in digital transformation. Recognized for its global leadership, DBS has been named “Best Bank in the World” and “Global Bank of the Year” as well as “World’s Best Bank” and “World’s Best Digital Bank” by prominent international financial publications. In 2019, DBS was also lauded by a leading international financial publication as one of the top 10 business transformations of the decade. A key driver behind DBS’ successful digital transformation has been its willingness to embrace new technologies such as virtualization, 5G, cloud, machine learning and AI.

“What differentiates us is our belief in being digital to the core, and to avoid simply applying ‘digital lipstick’ as was done in many other organizations,” explains Choon Boon Tan, Managing Director and Head of Cloud Engineering & Services at DBS. “This involved rearchitecting our technology stack, and subsequently establishing strong core competency in technology that is deeply seated within the entire organization.”

A fundamental aspect of this digital transformation has been a switch from how technology is engineered and deployed within the bank. “We adopted virtualized general-purpose compute at massive scale instead of expensive specialized hardware that is built for resiliency but often at a much higher cost. We also switched from traditional off-the-shelf software to opensource software which we can customize and enhance to better suit our environments. Lastly, we aggressively automated the way in which we deliver and operate technology services within the organization to reduce the time to market.”

This led DBS to adopt Dell EMC PowerEdge servers powered by AMD EPYC™ processors, enabling huge cost savings and a massive upswing in sustainability, all while achieving higher resiliency and faster release cadences.

Commodity servers: resilience in numbers

“When we first started this journey around eight years ago, we were like many other organizations,” explains Tan. “We had big monolithic systems.” But DBS realized that the journey to the cloud had been travelled before by some of the biggest tech organizations and leveraging their experience could help streamline and shorten the process. “Many significant and well-known Cloud-based companies had big monolithic systems and went through a phase where their technology just couldn't keep up with their digital needs. They also went through a transformation phase to get to where they are now that took them five to eight years. Maybe DBS could learn something and apply it to the bank’s transformation. Maybe we could also transform at a much faster pace.”

One of the common themes DBS discovered was the use of general-purpose hardware, instead of highly expensive monolithic solutions. “The mathematics of probability tells us that if you have more individual machines, and put them together as big clusters, the probability of failure is extremely low,” says Tan. DBS therefore achieves high resiliency through platform and design redundancy rather than paying a lot more for individual highly resilient servers. “In the past, the gold standard for hardware reliability would mean that the machine is up 99.999 percent of the time. But to have a high

resiliency machine like that, you have to pay a lot of money. In addition, the expectation is that it will not fail. However, no matter how resilient the machine is, at 99.999, there is still a 0.001 percent chance that it fails. Customers using a digital service expect the service to be available continuously. Where that 0.001 percent in the past was acceptable, in the digital space today, it’s not.”

A general-purpose server might offer 97 or 98 percent resiliency, but would be far less expensive, so many more could be purchased. “The probability of every one of them failing at the same time is near to zero,” says Tan. When DBS was investigating a provider for the replacement of their new servers, Dell Technology’s AMD EPYC processor-based systems showed the greatest potential to achieve DBS’s goals.

AMD EPYC CPUs provide virtualization at scale

DBS has made unprecedented use of virtualization in a private cloud deployment with wide adoption of management automation for a much larger number of virtual machines compared to the physical ones used by DBS’s previous infrastructure.

“Most organizations only virtualize about 50 percent of their workloads,” says Tan. “The rest are on expensive physical hardware. DBS now has 99 percent virtualization, and we are not even satisfied at 99 percent. Our target is to get to 99.6 percent. We also moved from enterprise software to open source, so that now 89 percent of our application workloads are running open source. Automation is especially important, too. When we first started on this journey, one system administrator managed less than 50 virtual machines, the industry standard. Now one system administrator manages 820 virtual machines.”

AMD EPYC processors were fundamental in pushing the envelope on general purpose compute virtualization. “AMD’s progress with EPYC processors allows them to have more cores,” says Tan. “That allows us to scale. The second thing about the AMD processor is the ability to connect to more memory. The number of modules has increased from the traditional 24 to 32, so we can have around 33 percent more memory capacity per server.” This has allowed DBS to radically increase the density of its data centers.

“One key element is for us to run more virtual machines on a single piece of hardware,” says Tan. “When we first started on this journey, we were running around 250 virtual machines within a single data center rack of compute. That was six years ago. We have since improved that density efficiency from 250 to 1000. That's a 4X improvement with close to 4X cost efficiency within six years.”

“Moore's law says that the number of transistors on a chip doubles every 18 months,” adds Tan. “By riding Moore's law, on the same footprint and by using commodity hardware, we are able to keep doubling our capacity every two years.” As DBS’s digital transformation has developed, the bank has rolled out and refreshed over a thousand Dell PowerEdge R7425 and R6525 servers powered by AMD EPYC processors, including 7542, 7642 and 7742 CPU models.

Greater sustainability and more room for growth

DBS transformed its data centers with AMD EPYC CPU-equipped PowerEdge servers, drastically reducing footprint, power consumption, and cost. “We were reaching around 90 percent capacity in one of our data centers six years ago,” says Tan. “Through the various transformation efforts, we shrank the footprint to a quarter of its original size. Our power consumption reduced by 50 percent over the same period. Our new quarter-sized data center is able to support 10x growth, providing us with 40x efficiency. This was made possible only through general purpose compute virtualization, open-source software adoption, and aggressive automation at scale.”

The savings have been enormous in financial terms as well as the more sustainable use of space and power. “When we moved from our traditional infrastructure to the new virtualized commodity server-based one, we reduced the cost by 75 percent,” says Tan. “By also switching to Open Source software and administration automation, we brought the total down to less than 8 percent of the original cost.” The relationship between DBS, Dell and AMD looks set to continue well into the future. “We continue to get value from AMD through the various generations of processors, enabling us to increase the number of workloads that we can deploy in our virtualizations. That allows us to continuously ride on Moore's Law, get a better cost efficiency for our business, and aid our digital transformation.”

About the Customer

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia, and South Asia. Recognized for its global leadership, DBS has been named “World’s Best Bank”, “Global Bank of the Year”, “Best Bank in the World” and “World’s Best Digital Bank” by leading international financial publications. The bank is at the forefront of leveraging digital technology to shape the future of banking. For more information visit: www.dbs.com.sg.

Case Study Profile

- Industry:

Banking and Finance - Challenges:

Enable rapid digital transformation with reduced costs - Solution:

Switch from enterprise to commodity hardware, apply virtualize-first principle, aggressive automation, and adoption of open source - Results:

50 percent data center power reduction, 75 percent reduced cost - AMD Technology at a Glance:

2nd Generation AMD EPYC 7542, 7642 and 7742 processors - Technology Partners: